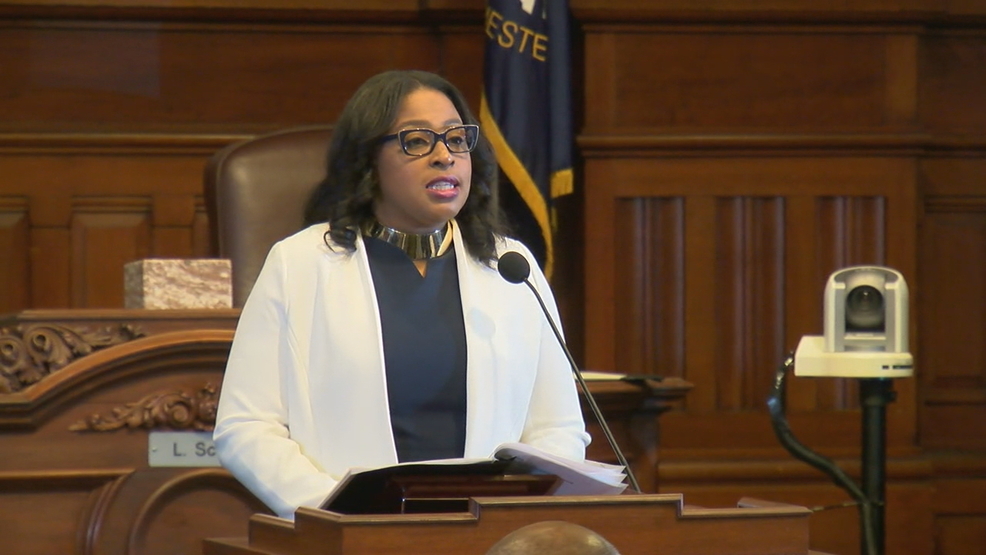

Spending plan maintains public safety, uses fund balance to limit tax increase

Rochester Mayor Lovely A. Warren today unveiled her annual operating budget for the City of Rochester— investing in new neighborhood police section offices, maintaining critical fire and police services and funding needed public infrastructure. According to the Mayor, the proposed budget is balanced and below the New York State Property Tax Cap.

The City further states that:

The 2018-19 spending plan is $539,646,900 versus the Amended 2017-2018 Budget of $527,018,400 (an increase of 2.4 percent). The total “Typical Homeowner Burden” (taxes and fees combined) increases a modest $43.37 or 1.85 percent under the proposed spending plan.

“This budget was prepared with significant citizen input and was designed to limit the burden on taxpayers while still investing in infrastructure, public safety, and important programs and services,” said Mayor Warren. “This budget year was not easy and, while comparable cities in New York face similar challenges as Rochester – with some proposing significant lay-offs of police officers and firefighters, other major reductions in workforce, service reductions, tax increases and even the complete depletion of reserve funds – we are able to deliver a balanced budget that maintains services, uses appropriate fund balances and applies efficiency while relying on only a modest tax increase. Despite our financial challenges, we continue investing in our citizens and in important job-creating growth for our city all while maintaining the highest levels of fiscal management and discipline.”

The budget was prepared with engagement from citizens who had access to public input forums including: a telephone town hall meeting, a facilitated open-access meeting at City Hall and online survey.

The City will be investing in new section offices to continue its community-focused police reorganization along with a significant $59 million investment in needed public infrastructure, and new police and fire recruit classes.

Albany is investing $50 million in capital funding for various job-creating ROC the Riverway projects (possibly including capital investment at the convention center, arena and other public infrastructure along the Genesee River).

“Governor Cuomo and our local state legislative delegation continue to provide significant assistance with important infrastructure and other job-creating funding, like ROC the Riverway, and we are grateful for their leadership and investment,” said the Mayor.

Operating support to the City through New York State AIM Aid remains flat, so the City will continue to face financial challenges and deficits related to the state mandated Maintenance of Effort (MOE) outlay for the school district. Under the mandate of the MOE, the school district consumes $119 million of the total $178 million in property tax dollars collected by the City of Rochester. The neighboring cities of Buffalo and Syracuse receive enough AIM Aid to more than fund their respective school districts’ MOE expenses, while Rochester’s share creates a deficit.

“Flat AIM Aid allocations, coupled with the mandated Maintenance of Effort payment, continues to present Rochester with a major fiscal challenge when preparing a balanced budget,” said Mayor Warren. “If Rochester were to receive AIM Aid commensurate with the ratios used in either Buffalo or Syracuse, our mandated Maintenance of Effort expense would not create yearly budget deficits. We will continue to work with state leaders to achieve a similar funding ratio as our peer cities.”

A fund balance of $16.8 million is used to balance the budget, along with a portion of Enterprise Fund balances to support capital needs in those funds. Rates will remain steady for Refuse and Local Works, with only a modest adjustment to water meter charges.

The budget continues to focus on the Mayor’s three priorities of more jobs; safer, more vibrant neighborhoods; and better schools and educational opportunities

Under the “More Jobs” category, there is continued support for anti-poverty initiatives through Kiva (crowd-funded micro loans for entrepreneurs), emerging worker-owned cooperatives, RMAPI and new initiatives of the Offices of Innovation and Strategic Initiatives and Community Wealth Building that focus on access to credit for small businesses. The budget supports the Inner Loop East Development and ROC the Riverway, along with better software and services to track MWBE participation goals for City projects. The budget extends funding to the Rochester Environmental Job Training (ReJob) Program and increases support for the Young Adult Manufacturing and Training Employment Program (YAMTEP) as part of an expanded focus on vocational training and hands-on work experience through partnerships with local employers. The budget continues funding for the Summer of Opportunity Program and City Urban Fellows.

Investments in “Safer, More Vibrant Neighborhoods” include the funding to acquire and design police section offices at neighborhood sites, as well as a new Community Affairs Bureau in the Police Department to strengthen police-community relations. Additional funding is directed to train new recruits in the police and fire departments and to develop a Continuity of Operations Plan for police and fire. The fight against blight includes money for the demolition of vacant and abandoned structures and for assistance programs that help homeowners maintain their properties, such as Roofing and Emergency Assistance Repair.

The budget provides for the completion of the Campbell R-Center improvements, including new play apparatus and a spray park. It increases capital support for the library, including the North Terrace Project and funds Quality of Life teams in Neighborhood Service Centers focused on commercial corridor improvement. Additional funding is directed to enhance security at special events and to update and implement the Nuisance Abatement Law.

Under the “Better Schools and Educational Opportunities” category, the Mayor’s budget increases staffing for the Arnett and Douglass branch libraries to provide more children’s services and expanded hours, as well as continuing the partnership with RCSD to provide Literacy Aides in City libraries and R-Centers. Continued funding for the City’s highly successful developmental screening for 3-year-olds remains a budgetary priority in 2018-19.

The budget also funds a variety of literacy programs, including Raising a Reader and Safe to be Smart. In the absence of the AmeriCorps grant, the budget continues funding for financial literacy and early childhood programs. It provides for a new sports magnet program at the Campbell R-Center that includes free sports training and fitness conditioning. It also continues the collaboration with RCSD to provide school-based violence prevention services through Pathways to Peace. It invests in an exciting new state-of-the-art nutrition center and demonstration kitchen at the Public Market.

The budget also allows for the City to seek innovation and efficiency gains through the final implementation of a new personnel/payroll system, the evaluation of recommendations from an organizational efficiency study and the ongoing replacement of street lights with energy-efficient LEDs. It provides for the new Traffic Violations Agency, which brought traffic violations under the City’s purview in May. The budget also expands Sunday hours for 311.

These investments and improvements come despite a budget process that began with a $47.6 million budget gap. This sizable gap was closed through a combination of expense reductions and revenue enhancements including: adjustments to planned capital spending; lower than expected pension and retiree medical costs; department reductions and efficiency; and adjustment to debt service among other cost saving measures.

The budget relies on some additional revenue from General Fund and Enterprise Fund balances, PILOT and surplus from the Health Care Rate Stabilization Fund. New revenue is factored in from traffic violations, the sale of property, mortgage and delinquent taxes, and Consolidated Highway Improvements or CHIPS. It also draws on the use of Premium and Interest to pay debt service and makes adjustments to CDBG and SRO reimbursement. Funding for the budget is rounded out with a modest property tax increase, small fee increases and additional sales tax revenue.

“We are reclaiming our city by investing in our neighborhoods, in job creation and in the education of our citizens – both young and old. The investments we make in our children and adults through our R-Centers and libraries, in our neighborhoods with infrastructure, and our collective future by embracing green initiatives and energy conservation are all investments in our people,” the Mayor said.

Mayor Warren’s proposed budget will go to City Council for review, with Council holding hearings on June 4, 12 and 13 and a vote at their meeting on June 19

To view the budget proposal or for more information on meeting/hearing dates, times and schedules, please visit the city’s website at www.cityofrochester.gov