Mayor Lovely A. Warren and Monroe County Executive Cheryl Dinolfo are urging local families who may qualify for the Earned Income Tax Credit (EITC) to take advantage of free online and in-person assistance to file their tax returns.

“We want to make sure our residents get the money they earned by taking advantage of the free assistance that’s available to help them claim any tax credits or refunds at the state and federal level,” Warren said. “Claiming the EITC can add several thousand dollars to a working family or disabled person’s annual budget.”

“Tax season can be a confusing and challenging time for everyone, but we want our residents to know that free services are available to help you get every dollar you deserve,” said Monroe County Executive Cheryl Dinolfo. “I thank the City of Rochester, United Way, the Central Library and all of our partners for providing this important assistance, and I encourage anyone who is eligible to take advantage of these opportunities right away.”

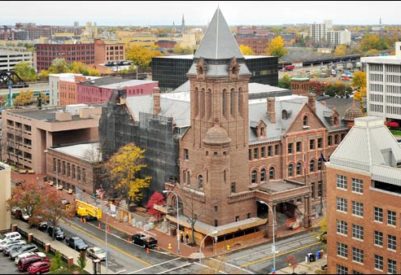

This year, the Bausch & Lomb Public Library Building downtown is hosting the C.A.S.H. (Creating Assets, Savings and Hope) program, run by the Empire Justice Center, which provides trained tax preparers at no cost to help qualified families and individuals complete their tax returns.

Another no-cost avenue for filing is the United Way-supported MyFreeTaxes. In-person help with navigating MyFreeTaxes is also available from trained facilitators at the Central Library, 115 South Ave. and at the City of Rochester’s new Business and Community Services Center, 30 N. Fitzhugh St. on the ground floor of the Sister Cities Garage.

“We are grateful for the partnership between the City of Rochester and Monroe County to support our working families and ultimately strengthen our economy,” said Jaime Saunders, president and CEO of United Way of Greater Rochester. “United Way has been proud to support the C.A.S.H. program for more than 15 years and to offer the MyFreeTaxes online platform to provide an easy tax filing resource. We continue to see the value of EITC in helping our local families thrive.”

To qualify for C.A.S.H., total household income must be less than $55,000 for families with qualifying children and less than $40,000 for childless workers. Taxpayers also must have worked and lived only in New York State (and not in New York City). If self-employed, certain other limits apply.

However, assistance is available to many more people – those earning up to $66,000 -- through the MyFreeTaxes.com website. The library will have trained facilitators from the New York State Department of Taxation and Finance available from 10-6 p.m. on Wednesdays. The City’s Business and Community Services Center will have laptops and facilitators available by appointment Tuesdays from 11 to 7 p.m. through April 9.

Taxes can be filed anytime between now and April 15.

For more information about free tax preparation resources available in Rochester and Monroe County and how to make an appointment, go to www.roccitylibrary.org or to www.cityofrochester.gov/freetaxhelp

For more information about C.A.S.H., go to www.empirejustice.org/cash. Due to high demand, appointments are encouraged.

For more information about the City of Rochester’s Business and Community Services Center, go to www.cityofrochester.gov/wealthbuilding.